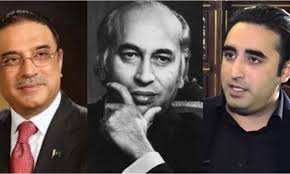

Foreign investors reluctant to invest in Pakistan: Bilawal Bhutto

Islamabad: Chairman Pakistan People’s Party (PPP) Bilawal Bhutto Zardari, has asked the Prime Minister to explain to the public why his government was compelled to repay Saudi Arabia’s USD 3 billion loan, and what it is going to cost the nation for taking a commercial loan from China to clear the Saudi soft loan.

The PPP Chairman said that Imran Khan had promised to break Pakistan free from the debt trap, but since coming to power he has buried Pakistan under loans, taking the begging bowl everywhere he goes. “He (Imran Khan) has extensive experience in soliciting alms and donations, but countries do not, cannot, and should not run on donations,” he stated.

The PPP Chairman said that the life of the common man in Pakistan had become unbearable due to the poor economic policies of Imran Khan’s regime. With the per capita debt now at Rs175,000, every Pakistani is paying the price for Imran’s Khans incompetence.

Common people would continue to suffer unprecedented inflation, poverty, and unemployment if the federal governments pushes Pakistan further into debt and compounds it with their corruption and mismanagement.

“Every person in Pakistan is paying a terrible price for the tsunami of Imran Khan’s transformation,” he added.

Bilawal Bhutto Zardari said that due to the circular debt crises, the government has been unable to keep its financial commitments to our international partners, putting projects such as CPEC at risk.

“The hesitation of the Chinese government in releasing the committed USD 6 billion funds for the ML-1 railway track, is in fact an expression of distrust in the PTI regime,” he said, adding that Chinese companies investing in Pakistan have also apprised the Chinese government of their distrust of the PTI government.

The PPP Chairman further said that the puppet Prime Minister had created a climate where foreign investors and governments had become reluctant to invest in Pakistan and engage with the federal government.