Italy: What does Algeria’s gas deal mean?

Rome: Natural gas giant Algeria has agreed to boost deliveries to Italy as European countries seek to reduce their reliance on Russian imports over the Ukraine war.

But experts say the North African country, despite its vast natural gas reserves, is already exporting at close to full capacity.

Algeria possesses almost 2.4 trillion cubic metres of proven natural gas reserves and is Africa’s largest gas exporter.

It is responsible for almost 12 percent of the European Union’s gas imports – against almost 47 percent from Russia, according to early 2021 figures provided by Eurostat.

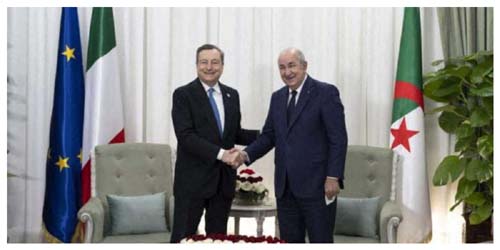

Few details have been released on the deal between Algerian state energy firm Sonatrach and Italian major ENI, announced by Italian Prime Minister Mario Draghi in Algiers.

ENI said in a statement that the firms had agreed to boost deliveries to Italy through the Transmed undersea pipeline by “up to nine billion cubic metres per year” by 2023-24. It did not specify a baseline figure or the volume of total deliveries.

Aydin Calik, an analyst at the Middle East Economic Survey (MEES), said the deal’s precise impact on quantities of gas to be pumped through the pipeline was unclear.

According to MEES figures, in 2021 Transmed only had spare pipeline capacity of 7.8 billion cubic metres per year — short of the nine billion of extra deliveries cited by ENI.

Experts also say a lack of foreign investment in new infrastructure and the need to cover growing domestic consumption will limit the gas available for export.

“Rising domestic demand and maturing natural gas fields continue to weigh heavily on volumes available for export,” said Calik.

“And while projects are underway to sustain export levels, the big additions aren’t scheduled until 2024.”

Gas price futures currently trade around 100 euros per megawatt hour, five times higher than this time last year.

According to a statement by Sonatrach, Monday’s deal allows it and ENI “to determine natural gas sales price levels in line with market data for the year 2022-2023”.

Calik said this could mean that Sonatrach has also secured a price rise for the gas it sells to Italy.

“But the thing is that we don’t exactly know the details of the deal,” he added.

Anthony Dworkin, a senior policy fellow at the European Council on Foreign Relations, said Algeria wants to make the most of opportunities to increase gas shipments to Europe and raise money to invest domestically.

But “it also wants to make clear that it is a reliable energy partner to Europe,” he said.

That is despite Sonatrach warning earlier this month it could increase the price of its gas sales to Spain, after Madrid dropped decades of neutrality and backed Algeria’s arch-rival Morocco over the sensitive Western Sahara issue.

“Prices may go up, but there is every indication that Algeria will honour its commitments — and there is a price review built into the contracts,” Dworkin said.

“Gas prices have increased anyway, so it is not surprising that Algeria might want to increase them.”

While Monday’s deal helps Italy reduce its reliance on Russian gas, Algeria has a long-standing relationship with the Kremlin which experts say it is unlikely to burn.

Dworkin said the North African country was “likely to continue to pursue a balanced policy based on maintaining relationships with both Russia and Europe”.

“It will probably try to avoid rhetoric that obviously suggests it is helping Europe in light of the war in Ukraine, but the deal with Italy showed that Algeria will remain a pragmatic actor,” he said.

He noted that the country buys most of its arms from Russia but also some from Italy and Germany, and that it had voted against or abstained from United Nations resolutions against Russia since the invasion of Ukraine.

“These are ways in which it preserves its ties with Russia,” he said, noting that the relationship does not require Algiers to deprive itself of “commercial opportunities for lucrative exports”.