Italy was the first and only G7 country to join the BRI; it may be the first to leave

The League’s policy on China has had its ups and downs, and then ups again. It was a League government in coalition with the populist Five Star Movement that put its name to the BRI in 2019 during a state visit accorded to Xi. Yet, just a few weeks before the signing, at the end of 2018, the League decided to distance itself from the BRI under pressure from Washington. As a result, Salvini did not attend the official events during the state visit and publicly lamented the fact that China is not a market economy. In July 2020, he protested outside the Chinese embassy in Rome in support of freedom for Hong Kongers. But the following year he then visited the Chinese ambassador in Rome in his capacity as party leader, officially to discuss the situation in Afghanistan. To this day, the League’s position on China remains unclear; it is likely to follow Brothers of Italy on China policy.

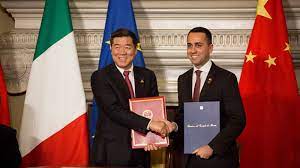

Italy was the first and only G7 country to join the BRI. With Meloni’s pledged review, it may be the first country to leave the initiative; this could trigger a process that leads other European states to do the same. In 2021, Lithuania became the first to quit the “17+1” cooperation format between China and central and eastern European countries. Others soon followed.

In the meantime, there remain the questions of how to deal with Chinese investments in Italian business. Stopping such deals is low-hanging fruit for the new government. After all, Draghi’s approach was highly protective of Italian assets, such as when he blocked Shenzhen Investment Holdings from acquiring the Italian semiconductor enterprise Lpe. Italy’s new, nationalistic prime minister is unlikely to be averse to making such choices. In a speech to the Italian senate, Meloni explicitly opposed predatory investments in strategically important Italian industry. Her “minister of enterprises and made in Italy”, formerly known as the minister of economic development, Adolfo Urso, has already stated the government’s intention to further strengthen the Italian screening mechanism for FDI to include new state assistance for Italian businesses hit by the decision to block certain transactions. He also hinted that the government may review deals involving Chinese investment that are already concluded.

In this regard, the Italian government may help strengthen the EU’s stance on China. The only caveat for EU policymakers is that the nationalist nature of the government means that it will not do so in a way that publicly cedes sovereignty or decision-making powers to EU institutions. For example, Italy is likely to favour stronger European mechanisms to screen investments, but not to accord more power to the European Commission.

China will remain secondary to the EU, the United States, and Italy’s immediate neighbourhood in Italian foreign policy. And it remains to be seen if Italy puts its money where its mouth is on China, above all, whether it does indeed conduct an early review of its participation in the BRI. But if Meloni’s government sticks to the positions she previously set out on China, Italy could more actively contribute to the shaping of a China strategy that prioritises both national interests and even EU interests too.

Francesca Ghiretti is an analyst at the Mercator Institute for China Studies (MERICS) and a current visiting fellow at ECFR in the context of the “European Caucus on China” project.