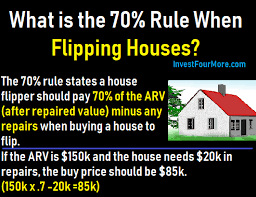

What is the 70 % Rule in House Flipping?

Sadia Khanum

The 70% rule is a very common term among the real estate investors when it comes to buying and flipping the houses. This rule enables us to determine the best price to pay for the distressed property and flip to earn a profit.

In simple words, the 70% rule states that as an investor you should pay 70 percent of the after-repair value (ARV) of a distressed property minus the estimated repair cost it needs to be restored. The ARV is the estimated worth of a house after it is being fully repaired.

Let’s Make It More Simple

Let’s have a practical example of this rule. Suppose the resale value of a house after all the repairs is $150,000. Total repairs will cost you $25,000. There are always unknown expenses, let’s put them at $4,500. Selling commission and other closing fees are approximately $6,500. The estimated cost of utility bills, insurance, and the maintenance of the lawn will be at $2,500.

Now when you minus all these costs from the resale value of the house, the break-even point will be $111,500. Now if you want a profit of $25,000 on this then you should buy this property for $86,500.

How To Do It

Utilizing this formula is not complicated rather it is very simple. Think about all the costs that are related to the property. Try to make an accurate assessment of the repairs required to rehab the property. Take the exact fees and dues related to the property. Add a reasonable amount for the unseen expenses. The holding cost of the property and the commissions for reselling. Decide on the legitimate profit you want to have on this and made an offer. Always keep the market trend and the competition in your mind as these things will make your quotation very viable and attractive.

Why The 70% Rule is Critical

This formula is very critical because in real estate the profit is made when you can buy the property at the right amount. If you did not calculate the expenses required on repairs and other things involved accurately, your profit margins can diminish quickly or even can be wiped out. You should estimate the ARV and the rehab values precisely as any inaccuracy will force you to operate on less than desirable margins.

Your Exit Strategy is Very Important

Your exit strategy matters the most in your real estate endeavors. What is your plan? You want to buy and flip or you want to hold the property for some time to have more profit. This rule will fluctuate on the basis of the exit strategy you have. Clearly, the landlords will pay more than someone who intends to flip the house. This rule is very effective when you are interested in flipping. But when you have favorable financing on your disposal and the area is desirable, you can go up to 90% of the ARV.

Other Influential Factors to Consider

There are several other factors that are very influential. As you know the real estate is a local business so the value of the formula will have to be adjusted according to the market you are buying in. The magical 70% number can go up to even 85% or as low as to 60% according to the market value of the area. You will also have to consider your competition when quoting the price.

Every investment opportunity is different. Different timelines, different markets, different requirements, different costs, and different risks. So, keeping all the factors that can affect your investment into consideration is strongly advised.

How Accurate is The 70% Rule

As described above, this rule brings you extremely close to the right amount when deciding on an investment you want to make on a property. It is great if you can get a house cheaper than this, but in this tough and competitive environment, it is difficult to achieve. However, for the beginners, this rule is highly beneficial to get an idea of the amount to pay for the flip. But make sure your estimate regarding the repairs and other costs involved should be accurate.

Can You Go Above the Suggested Amount?

A very simple and straight answer to this question is Yes. When the market is appreciating, then getting a good deal with this rule is very difficult. You will have to explore other ideas too. But you should stay on the safer side as nobody knows if the market will continue to rise, stay balanced, or even decrease. Many flippers got into trouble during the last housing crisis. Even in the increasing market, it is better to stick to your rules and guidelines as it is better to have fewer deals and make money than many deals with no money.

Other Options

Yes, there are other options you can follow. Also, it is not possible that one percentage works universally across different markets, investors, project type, and so on. There are other ways to find whether or not a project is likely to provide a suitable spread to complete the investor’s targets. Secondly, using a fixed rule to two entirely different projects does not make much of a sense. In some supply-constrained markets, the investors may consider going for a property at 80 percent of the ARV as a good deal. So, sticking to only one rule is not a wise thing to do.

Conclusion

The 70% rule is one of the real estate investment rules that has great advantages for the investors, but, rules are meant to be broken. It is not a hard and fast rule rather you should take it as a guideline to follow when you are flipping a house or a property. Experienced best local contractors also advise considering the very important factors like the local market, housing type, related costs, and your exit strategy when you are going to place your offer. This will make your offer more competitive and effective and you will have a better chance to earn a profit.