UK growth since 2010 has been lacklustre and largely driven by immigration, says report

Rishi Sunak’s pre-election claim that the UK economy is now “going gangbusters” is undermined today by a report which argues that growth since 2010 has been “unspectacular” and has been the result of a rising population, caused principally by high levels of immigration.

The study, Life in the Slow Lane, from the politically independent Resolution Foundation, will add to the consensus among economists and academics that the fundamentaleconomic problems and challenges facing this country are being dodged by the parties during the general election campaign.

Both Labour and Tories have vowed to bring down immigration if they form the next government, while saying little on how they willincrease productivity through higher investment to stimulate real, long-term growth. The report says that population growth averaged 0.7 % a year in the UK since 2010, the equivalent of six million people, and has been the prime driver of what GDP growth that there has been. Three-quarters of this total population growth was the result of immigration.

“Looking at GDP per capita, which accounts for population growth, the UK’s overall and relative performance is far worse,” the Foundation says. “GDP per capita has grown by a mere 4.3% over the past 16 years, compared to 46% in the years prior.” The report says the growing population has masked the UK’s “atrocious” record on productivity (output per worker) which grew by just 0.6% a year in the 2010s. Since the 2008 financial crisis. productivity growth has been the slowest for two centuries.

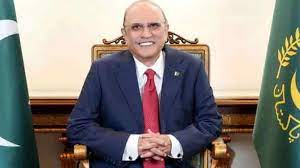

David Willetts said: ‘The growth of GDP per head is far too low. We have got to boost investment to get the economy growing.’ Photograph: Xinhua/REX/Shutterstock

Tory peer David Willetts, president of the Resolution Foundation, said: “Our report shows that crude figures on GDP growth exaggerate our performance because the population has been going up. The growth of GDP per head is far too low. We have got to boost investment to get the economy growing and the party manifestos have to recognise how serious the problem is and show how to tackle it. The campaigns so far haven’t really tackled this challenge.”

Looking ahead, the report says that the employment boom of the 2010s is unlikely to to be repeated. Migration levels are expected to fall, from 685,000 in 2023 to around 350,000 annually over the next five years, while an unhealthy population and the fact that much of the UK’s large baby boomer cohort will be retiring, will put further downward pressure on future growth of the workforce.

Greg Thwaites, research director at the Resolution Foundation, said: “The extra 6 million people in Britain have certainly made the economy bigger, but have done little for GDP per capita. The UK’s record on productivity – which is what really matters for living standards – is exceptionally bad.”

Since 2019, the UK has strengthened its position as the world’s second-biggest exporter of services after the US, the report says. But “far less welcome” has been its “weak performance on goods trade” with 57% of manufacturing businesses “still wrestling with the additional paperwork, customs duties and border checks which have increased exporting challenges post-Brexit.”

Sunak has been claiming that the UK’s return to growth in the first quarter of 2024 means the economy is “going gangbusters”, in an attempt to boost the Tories’ election chances.

The Resolution Foundation report puts Sunak’s claim into context: “A single quarter of growth doesn’t tell the whole story, however – what matters is the big picture of how the economy has been performing since 2010, where the picture remains one of stagnation since the financial crisis. In this context what ultimately matters for household living standards is not GDP growth but growth in productivity… On this measure, the 0.4% annual growth rate in productivity since 2007 is the lowest over an equivalent period in 200 years, and this has left the average real wage £14,400 below its pre-financial crisis trend.”