EU puts its weight behind home-grown processor for its new €273M supercomputer

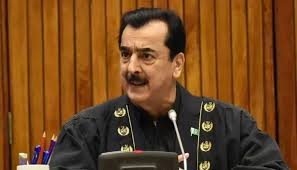

Brussels: SiPearl founder and CEO Philippe Notton

When Europe inaugurates its first exascale supercomputer later this year, the event will be a major step towards European sovereignty in computing.

Unlike previous EU-backed supercomputers launched within the EuroHPC joint undertaking, the Jupiter system will be powered by European microprocessors designed by SiPearl, a European start-up which beat off competition from Intel to win the contract with its Rhea chip.

With supercomputers essential to technological sovereignty in areas such as artificial intelligence, medical research and climate change, the “designed in Europe” tag is not just good for marketing copy.

“We have full control over the source code, and are certain there’s no backdoor,” said SiPearl founder and CEO Philippe Notton. “In terms of cybersecurity, that’s fundamental,” he told Science|Business.

Jupiter, which will be capable of more than one trillion calculations per second, will also use graphics processing units from the US firm NVIDIA.

The €273 million supercomputer, co-funded by the EU and the German government, is SiPearl’s first customer. The company says this is a major milestone in fulfilling the mission it was assigned by the EU through the European Processor Initiative (EPI) consortium, to promote European technology sovereignty with the delivery of a high-performance, low-power EU processor.

Notton was working for Atos in 2018, when the French company and 22 other partners in EPI won the call to develop the processor. It was proposed to set up an independent private company to carry out the work, and in 2019 SiPearl was formed as a member of EPI.

Following the award of the contract last September, SiPearl aims to begin production in the coming months, with Jupiter expected to come online at the Forschungszentrum Jülich campus in North Rhine-Westphalia later this year.

The company is also targeting EuroHPC supercomputers which will come after Jupiter as potential clients, including a €540 million exascale system to be installed in France by early 2026. It could also supply chips for smaller systems designed for the private sector.

While it is an independent company, SiPearl has had access to potential partners and customers through the consortium. Even more crucially, it started out with €6.2 million in Horizon 2020 grants, which allowed it to skip some of the painful early stages most start-ups go through.

When combined with French R&D tax credits, the company took in €20.5 million in non-dilutive funding before having to seek equity financing. In April 2023 it raised €90 million in a series A round, a big step towards the €150 million needed to launch the first chip.

Notton said it was not easy attracting private investors, and while Atos and fellow microprocessor design company ARM invested in the round, €15 million came from the European Innovation Council and €25 million was in the form of a convertible loan from the European Investment Bank. The French government’s technology sovereignty fund also invested.

“We were only able to [raise the money] because we had an enormous amount of public support,” Notton said. “There are clearly not enough private investors in Europe who are interested or involved in semiconductors.”

This underlines the importance of grants and public procurement in promoting home grown technology. Notton argues European companies bidding for public tenders should be given preference, through a ‘European Buy Act’ a proposal French president Emmanuel Macron referenced in a speech at the Airbus site in Toulouse in December.

“A cultural revolution is required. It happens in the US, in China, in Japan, but not yet in Europe,” Notton said.

SiPearl is also facing hurdles in scaling up across Europe. The company has spent several months trying to set up an Italian subsidiary, and has struggled to secure local grants in Spain, where it is seen as a foreign entity because its Spanish subsidiary is fully owned by the parent company, based in France.

Microprocessors which are more powerful but consume less energy are seen as a strategic necessity for Europe to reconcile its climate targets with the vast amounts of energy needed to run data centres.

A 2015 report by US Semiconductor Industry Association and the Semiconductor Research Corporation estimated that by 2040, the energy required for computing will exceed the world’s energy production.

“With a supercomputer, you can easily reach the consumption of a town like La Rochelle with 100,000 inhabitants,” said Notton. “And it’s so expensive, you can’t justify turning it off now and then.”

In his speech in Toulouse, Macron called on industry to work on reducing energy consumption “by 100 or 1,000” compared to today’s processors and graphics processing units.

That target is “a little bit optimistic”, according to Notton. The Rhea processor uses Arm technology, usually found in smartphones, which is already energy-efficient, and he said it should be possible to cut energy use in half from one generation of processors to the next.

Reducing energy consumption though means more complex, and expensive, manufacturing processes. Rhea, like the vast majority of the world’s most advanced chips, will be manufactured offshore by Taiwan Semiconductor Manufacturing Company.

The US has invested heavily to onshore production, supporting TSMC to build a plant in Arizona, but that project has been beset by delays and union disputes.

Semiconductor fabrication facilities cost in the tens of billions to build. “In the US, there is Qualcomm, Apple, Meta, Microsoft and Amazon, which all develop their own components, and have enough products to justify a factory. In Europe, it’s more complicated,” Notton said.

Intel is planning to build a €30 billion chip manufacturing plant in Magdeburg, Germany, with the support of the German government. It is possible that in future SiPearl processors could be made there, but the company first needs to know when the site will be up and running. The first of the two factories is currently expected to begin production within four or five years.

“In semiconductors, you choose the factory at the start of the cycle, before designing the product,” said Notton. That means decisions are made two to four years out. Added to that in takes time for new facilities to bed in and ramp up quality and quantity. “A factory needs almost five years before it is honed and starts having a very good output,” Notton said.

In December, Notton joined others from the semiconductor industry in Brussels for the launch of the Chips joint undertaking, which is responsible for implementing the EU Chips Act.

That legislation came about as a result of microprocessor supply chain interruptions during the COVID-19 pandemic, which left EU manufacturers without these critical components.

SiPearl was active in the discussions about the cloud-based design platform that will be set up as part of the Chips Act, providing shared computing resources and tools that will allow companies to refine their designs at a much lower cost.

This will come too late for SiPearl, which has already developed its own design platform, but Notton believes it will be crucial in addressing the “enormous costs” of design technologies which are currently a barrier to start-ups.

Such a centralised system does raise issues of data protection and intellectual property rights, a detail that still needs to be clarified. “This design platform must be hosted in the sovereign European cloud,” Notton said.